I work at NN

I work at NN IP

I no longer work at NN/NN IP

I am retired

Socially responsible investing

Return goes into your pension

All pension funds invest the contributions that have been paid into them. The return they make on those investments enable them to pay you your pension when you retire – preferably a pension that keeps up with inflation so your spending power stays intact. After all, it is likely that thirty years from now one euro won’t buy you as much as it does today.

Prudent investment policy

NN CDC Pensioenfonds has in place an investment policy (Dutch only) with a long-term horizon. While part of your eventual pension benefits will be paid from contributions paid into the pension fund, the largest part will be funded from return on the pension fund's investments. To ensure that there will be sufficient return, NN CDC Pensioenfonds has in place a prudent investment policy which is neither fully risk averse nor fully risk prone, but rather a mix of the two. Based on this policy, the pension fund works with two investment portfolios: a matching portfolio and a return portfolio.

Matching and return portfolios

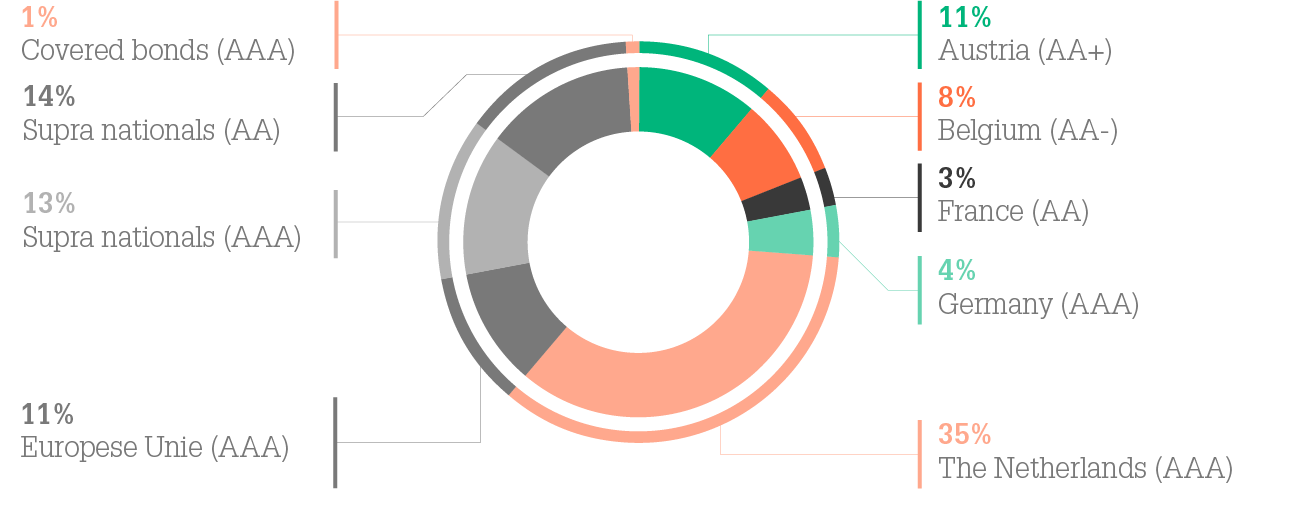

The matching portfolio accounts for approximately 60% of the pension fund's invested assets. The pension fund uses this portfolio to match its investments with its current and future commitments. This portfolio consists of mainly highly rated European soevereign bonds, which have relatively low risk profiles.

Distribution matching portfolio

Source: Annual Report 31 December 2021

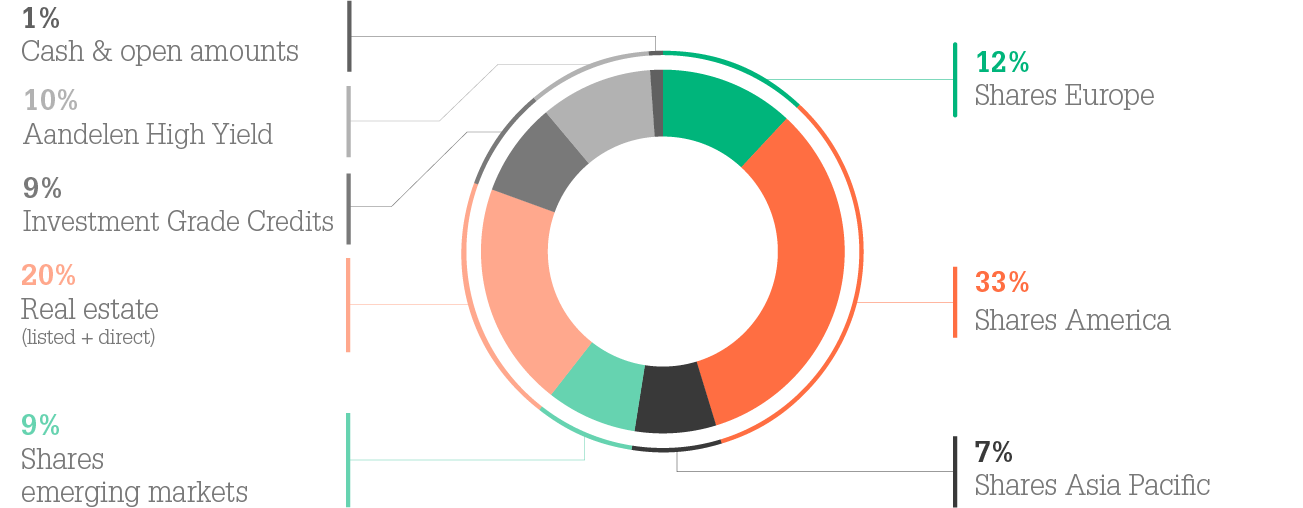

The return portfolio, accounting for some 40% of the pension fund's invested assets, serves to enable indexation. Through this portfolio, which has a higher risk profile, the pension fund aims for higher returns by investing in equity and property.

Distribution return portfolio

Source: Annual Report 31 December 2021

Socially responsible investments

NN CDC Pensioenfonds feels socially responsible and therefore has in place a policy for socially responsible investments (SRI). At present, our SRI policy entails an exclusion list for countries we do not invest in as well as an exclusion list for companies we do not invest in. Moreover, the mandate for equity in developed markets is conducted through specific proxy voting and engagement activities – in this respect, the fund participates in the State Street Global Advisors stewardship programme. The fund does not have in place a system to monitor the relevance and materiality of environmental, social and governance factors, or the methods needed to take such factors into account. This is because the pension fund considers the cost of such a system disproportionate to the nature, scale and complexity of the fund’s activities.

The investments underlying this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

One of the specific topics of the pension fund's SRI policy is sustainability. The pension fund's policy does not include an assessment of the adverse effects of its investment decisions on sustainability factors. This means the pension fund does not conduct an ESG due diligence regarding the identification and prioritisation of the adverse effects and indicators of its investment decisions on sustainability factors.

There are several reasons why the pension fund does not do this. In this respect, the pension fund makes a distinction between the internally and externally managed investments and between sovereign/semi-sovereign bonds, corporate bonds and equity.

The pension fund does not consider an ESG due diligence policy appropriate with regard to sovereign/semi-sovereign governments in EU countries. For companies, on the other hand, an ESG due diligence is considered appropriate. ESG due diligence reviews are currently not being conducted with regard to internally managed investments. This is because the pension fund considers the cost of such a policy disproportionate to the nature, scale and complexity of the work involved. When selecting an external party, an assessment is made of the overall SRI policy adopted by the party or fund in question. The ESG due diligence policy is not included in this process at present, but this could change in the future, when SFDR has been implemented by market parties.

Frequently asked questions

For more information, click on the questions below.

How does the SRI policy work out for the matching portfolio?

The matching portfolio invests solely in European countries and semi-government debtors which are rated at least AA-. This means the portfolio does not invest in countries on the exclusion list.

How does the SRI policy work out for the return portfolio?

The return portfolio invests in equity in developed and emerging markets, as well as in real estate, investment grade corporate bonds and high yield corporate bonds.

- Equity in developed markets is managed largely by way of a discretionary portfolio held at State Street Global Advisors. State Street Global Advisors is included in the 2020 PRI Leaders Group and as such scores well in terms of socially responsible investments. As NN CDC Pensioenfonds has full control over this discretionary portfolio, it does not invest in companies mentioned on the exclusion list. The pension fund also participates in the State Street Global Advisors stewardship programme through this discretionary portfolio.

- A limited part of equity in developed markets is currently managed by one or more Exchange Traded Funds (ETF). ETF fund managers determine their SRI policy independently, while NN CDC Pensioenfonds is a participating investor and therefore has no control. This means it cannot be precluded that an ETF invests in a company mentioned on the list of excluded companies. Going forward, the weight of the assets invested in developed markets through these ETFs will gradually be reduced.

- Equity in emerging markets is managed through two investment funds. These investment funds determine their SRI policies independently from NN CDC Pensioenfonds. While the theme of sustainability is an integrated part of their investment policies, it cannot be precluded that these two funds invest in a company mentioned on the list of excluded companies. However, this is monitored annually and, at the time of the initial selection of the two investment funds, this was not the case.

- A minor part of equity in emerging markets may be managed by two Exchange Traded Funds (ETFs). ETF fund managers determine their SRI policies independently, while NN CDC Pensioenfonds is a participating investor and therefore has no control. This means it cannot be precluded that an ETF invests in a company mentioned on the list of excluded companies. The relative weight of this category will be zero in most cases.

- Real estate investments are made through a Dutch retail property fund and two residential property funds in the Netherlands, none of which invest in excluded companies. These investment funds determine their SRI policies independently from NN CDC Pensioenfonds, with the theme of sustainability being an integrated part of their investment policies. In addition , these funds take part in the Global Real Estate Sustainability Benchmark (GRESB) ), for which they score well.

- Real estate investments are also made through ETFs that invest in listed real estate worldwide. ETF fund managers determine their SRI policy independently, while the pension fund is a participating investor and therefore has no control. This means that, for these investments, it cannot be precluded that an ETF invests in a company mentioned on the list of excluded companies. Going forward, the relative weight of equity invested in listed real estate through these ETFs will gradually be reduced.

- The investment grade corporate bond portfolio is managed by the pension fund itself, by way of a discretionary portfolio. As NN CDC Pensioenfonds has full control over this discretionary portfolio, it does not invest in companies mentioned on the exclusion list.

- High yield corporate bonds are managed by two ETFs. This means it cannot be precluded that the ETFs invest in a company mentioned on the list of excluded companies.